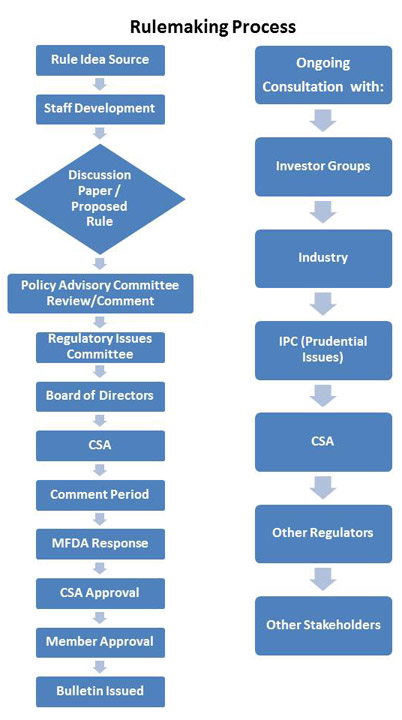

The following is a description of the procedure for the development or amendment of MFDA Regulatory Instruments (Rules, By-law No. 1, Policies and Form 1).

Sources of New Policy Initiatives

New Regulatory Instruments or amendments to existing Regulatory Instruments may result from:

- Common deficiencies identified during compliance reviews and issues that arise from enforcement activities;

- Comments, inquiries or frequently asked questions from Members;

- Applications for exemptive relief;

- Issues raised by MFDA Policy Committees;

- Requests from the Canadian Securities Administrators (“CSA”); and

- Initiatives and projects of other regulators.

Development of Recommendation

MFDA staff is responsible for developing and drafting recommendations for new Regulatory Instruments or amendments to existing Regulatory Instruments. Staff evaluates issues that might inform any proposed changes, such as impacts on Members and investors. MFDA staff also conducts legal research and reviews practices adopted by other self-regulatory organizations and regulators.

Consultation

The MFDA seeks preliminary comment on material policy initiatives in order to ensure that stakeholder views and comments are considered at an early stage in policy development process. Comment on material policy proposals is sought through various means, including discussion papers, surveys and meetings with stakeholders.

MFDA staff solicits comments and feedback from a broad representation of Members at semi-annual Member Regulation Forums with respect to current and upcoming regulatory developments and initiatives under consideration by the MFDA. Staff also meets with investor associations to obtain input on MFDA policy initiatives.

All material proposed Regulatory Instruments are referred to the MFDA Policy Advisory Committee (“PAC”) for input and comment.

Any recommendation respecting new prudential requirements or amendments or deletions to existing MFDA prudential requirements is also presented to the MFDA Investor Protection Corporation (“IPC”) for comment prior to consideration by the MFDA Board of Directors.

Review and Approval Process

MFDA Board Review and Approval

Recommendations respecting the development or amendment of Regulatory Instruments are presented to the Regulatory Issues Committee of the MFDA Board of Directors for discussion, analysis and guidance prior to consideration of those Regulatory Instruments by the full Board. Documentation prepared by MFDA staff for review and consideration by the Regulatory Issues Committee reflects input obtained by staff during consultations.

All new and amendments to existing MFDA By-laws, Rules and Forms require the approval of the MFDA Board of Directors. MFDA staff also seeks approval of the Board for new or amended MFDA Policies. Staff prepares and presents recommendations with respect to Regulatory Instruments to the Board and advises the Board of the views of the Regulatory Issues Committee and of the consultations with MFDA Members and the CSA.

CSA Review and Approval

All amendments to Rules, By-laws, Policies and Forms require the prior approval of the recognizing securities commissions. The British Columbia Securities Commission is the Principal Regulator in coordinating the review and approval of MFDA Regulatory Instruments.

After the proposed Regulatory Instrument is approved by the MFDA Board, MFDA staff files it with the contact staff person at each recognizing securities commission. Regulatory Instruments are classified as housekeeping or public interest amendments. All public interest amendments are published for comment.

If any material amendments to the proposed Regulatory Instrument are necessary as a result of the comments received, MFDA staff resubmits the amended Regulatory Instrument to the PAC, Regulatory Issues Committee and Board for review and approval and refiles the amended Instrument with CSA staff for another comment period.

Following the resolution of comments by the public and CSA staff, the proposed Regulatory Instrument is presented by CSA staff to the recognizing securities commissions for approval, non-disapproval or non-objection (“approval”).

Once all recognizing securities commissions approve the proposed Regulatory Instrument, MFDA staff publishes a bulletin announcing CSA approval, and CSA staff publishes a notice of approval to a Rule amendment on the Principal Regulator’s website.

Member Approval

All MFDA Rules, By-laws and Forms and amendments to these instruments require the approval of MFDA Members. MFDA staff presents the proposed Regulatory Instrument or proposed amendment to MFDA Members for approval at the next Annual General Meeting of Members (or a special meeting called for the purpose of considering the same).

Effective Date

Once all requisite approvals are obtained, new Regulatory Instruments and amendments to existing Regulatory Instruments become effective on a date determined by the MFDA. MFDA staff publishes a bulletin that summarizes the new Regulatory Instruments or amendments, includes the text of the Regulatory Instrument or amendments, and announces the effective date.